Ca 540 Tax Rate Schedule 2024 – Californians pay the highest marginal state income tax rate in the country — 13.3%, according to Tax Foundation data. But California has a graduated tax rate, which means your rate increases with your . California follows the federal guidelines for IRA contributions. You can claim the California earned income tax credit (CalEITC which may involve lower rates on capital gains, the state .

Ca 540 Tax Rate Schedule 2024

Source : www.ftb.ca.govCalifornia Income Tax 2023 2024: Rates, Who Pays NerdWallet

Source : www.nerdwallet.com2023 Personal Income Tax Booklet | California Forms & Instructions

Source : www.ftb.ca.govunited states Schedule CA 540 Part I Section A: what role do the

Source : money.stackexchange.com2023 Personal Income Tax Booklet | California Forms & Instructions

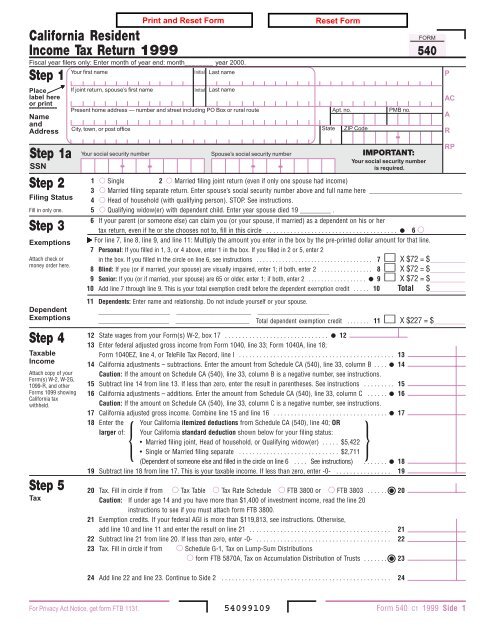

Source : www.ftb.ca.govForm 540 1999 California Resident Income Tax Return

Source : www.yumpu.comTTB Products

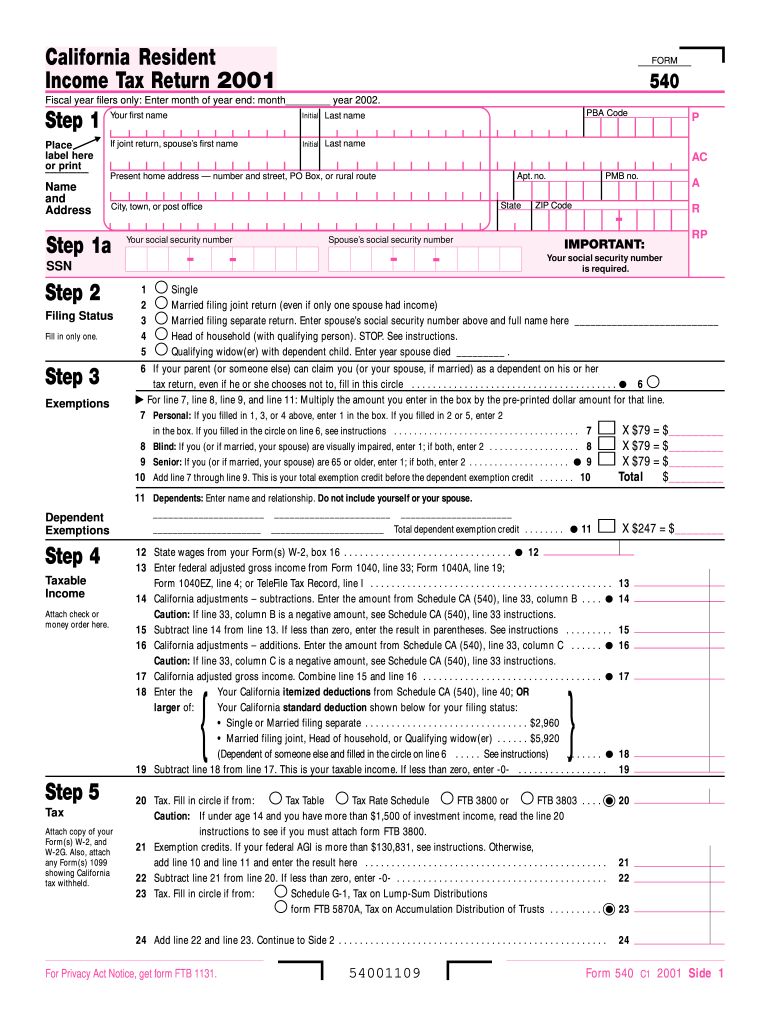

Source : www.thetaxbook.comFORM 540: California Resident Income Tax Return | Community Tax

Source : www.communitytax.comState income tax Wikipedia

Source : en.wikipedia.orgWhat is form 540: Fill out & sign online | DocHub

Source : www.dochub.comCa 540 Tax Rate Schedule 2024 2022 Personal Income Tax Booklet | California Forms & Instructions : Use our Retirement Calculator to help estimate what to save now so you’ll have what you need later. Help Register Login Login Games Car rental AARP daily Crossword Puzzle Hotels with AARP discounts . California also has one of the highest sales tax rates in the U.S., especially on gasoline. The Golden State also enacted a new tax on guns and ammunition last fall. [Data for this state tax guide .

]]>